What is CBD oil? Cannabidiol oil popularly known as CBD oil is an extract from the cannabis plant. C…

Wellness

CBD Balanced

Hemp Nutrition

100% Plant Based

Consultation

CBD x ENDOCANNABINOID SYSTEM (ECS)

The working of Hemp and CBD restores our natural balance upon interaction with ECS system to promote Homeostasis

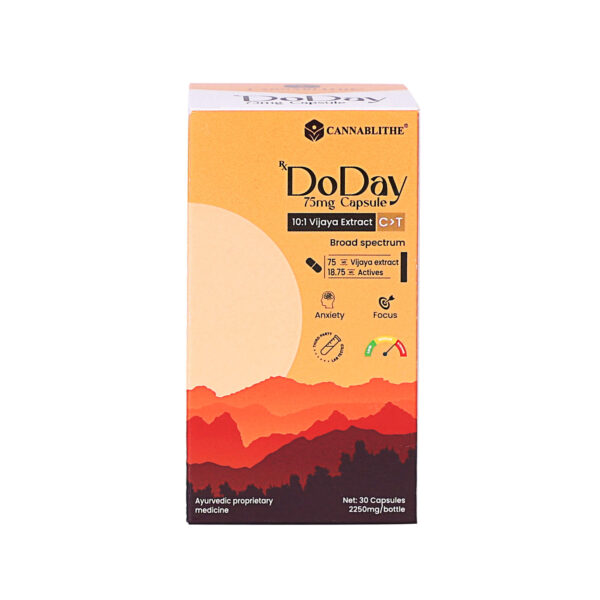

Bestseller

At our online store at https://cannablithe.com/, we will empower individuals to experience the potential of top-quality CBD oil. If you want to buy CBD oil in India, we will be the right destination for you.

Why choose our CBD oil for sale?

We are known to prioritize sourcing the best CBD oil India from reliable suppliers. In this way, we will make sure that you receive a top-quality product that is safe as well as potent. All CBD capsules India provided by us have been tested to verify their genuineness. We also make sure that the THC levels remain below 0.3%. We believe in transparency and will provide you with honest and comprehensive information about CBD oil for sale. It will help you to make sensible decisions when it comes to your health.

Explore a diverse range of products

Our company caters to an extensive range of requirements by providing a comprehensive selection of cannabidiol oil in India products. Our products can boast of having a diverse array of strengths, formulations, and flavors. If you buy CBD oil in India from our company, we will customize your experience according to your preferences.

Embrace a healthier and happier you

By providing CBD capsules India and other similar products, we will help you to achieve a greater sense of balance and well-being. Therefore, do not hesitate and place your order today to purchase CBD oil India from us. It will help you to embark on a transformative quest towards a more vibrant you!

Latest Reviews

Popular Questions About Cannabis Oil

What are cannabinoids?

Cannabinoids are natural elements found in cannabis plants. There are hundreds of cannabinoids, but the active and most researched are CBD, CBC, CBN, THC, THCA.

What is medical cannabis?

Medical cannabis is the administration of cannabis-infused medicines and cannabis-derived compounds under the supervision of medical professionals.

CBD and THC

These are two of the most actively researched cannabinoids present in the cannabis plant. CBD is non-psychoactive and has therapeutic properties, whereas THC causes psychoactive effects on users. All compounds found in cannabis plants work together synergistically to accelerate the medicinal effects.

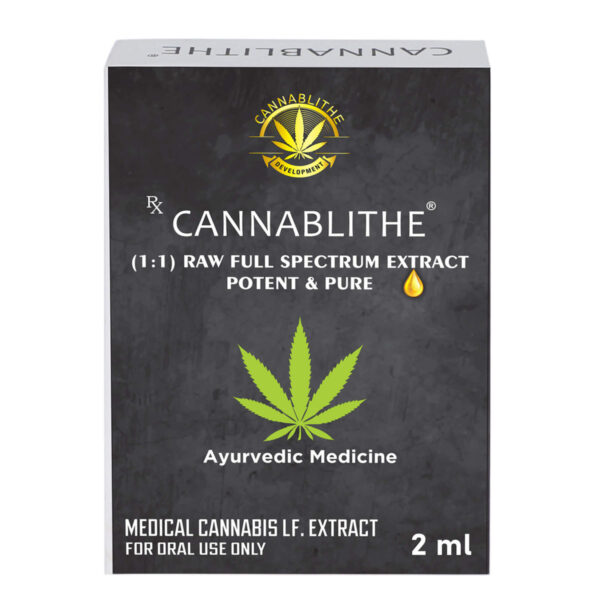

What is the extraction process?

We use full-spectrum formulations for the goodness of whole-plant cannabinoids, i.e. CBD, CBG, CBN, CBC, THCA, and others.

Full-spectrum vs broad spectrum

Full-spectrum CBD oil contains higher levels of different active cannabinoids. When FSO goes through the further process for separating THC, the oil becomes a broad spectrum with only trace amounts of THC more of CBD. The separation process also removes other essential cannabinoids leaving them in trace amounts.

ENTOURAGE EFFECT

Psychoactive compounds in cannabis are responsible for euphoric effects on users. A full-spectrum oil may induce an entourage effect on users and giving an uplifting feeling.